SafeSend Returns:

How It Works

HeimLantz CPAs and Advisors uses SafeSend Returns—a secure, simple, and paperless way to deliver and sign your tax returns online. With just a few clicks, you can review, sign, and return your documents digitally from your computer or tablet.

Getting Started

For the best experience, we recommend using Google Chrome when accessing SafeSend Returns.

Here’s the process, step by step:

-

- When your tax return is ready, you’ll receive an email from HeimLantz CPAs & Advisors, LLC via noreply@safesendreturns.com.

- The subject line will say: “Please review your tax return and sign your e-file forms.”

- To ensure delivery, add this email address to your safe sender list.

- If you don’t see it, check your Spam/Junk folder.

2. Access Your Return

-

-

The email will include a secure link. Click it to open SafeSend Returns.

-

You’ll be prompted to answer a few identity verification questions (required by the IRS).

-

3. Review and Sign

-

- Once verified, you can view your tax return in full.

- Follow the prompts to electronically sign your e-file authorization forms.

4. Submit and File

-

- After signing, your return is automatically sent back to HeimLantz for electronic filing.

- You’ll also be able to:

- Make tax payments online, or

- Print payment vouchers for mailing.

Helpful Links

Want to see the process in action? Watch these quick videos:

SafeSend FAQs

Is it safe to enter my Social Security number?

Yes. SafeSend is a secure platform for viewing and signing your e-file authorization form(s). Look for HTTPS:// at the beginning of the site URL and a locked padlock symbol in your browser’s URL bar to confirm you’re using a secure site.

I cannot find an email from HeimLantz CPAs and Advisors at noreply@safesendreturns.com

- Check your junk/spam folder.

- Add noreply@safesendreturns.com as a trusted sender or a contact to prevent the email from being blocked or marked as spam.

- Use the search feature in your mailbox to look for an email from HeimLantz CPAs and Advisors noreply@safesendreturns.com; be sure to search all folders.

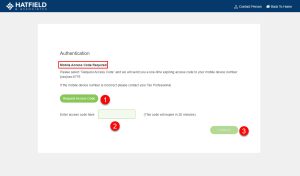

How do I receive the access code?

- Once you have clicked on the link to access your return and enter your last four digits of SSN (for personal returns only). The Access Code Required window will open.

- The green Request Access Code button must be clicked for a code to be generated. Please keep this window open.

- You will receive a separate email from HeimLantz CPAs and Advisors noreply@safesendreturns.com with the access code provided within 1-5 minutes or via text message. (Please check all mailboxes including spam/junk)

- Access codes will expire after 20 minutes, after they are used, or when a new code is generated.

Where do SafeSend's Knowledge-Based Authentication (KBA/identity questions come from?

SafeSend allows firms to use Knowledge-Based Authentication (KBA) questions to verify a taxpayer’s identity before granting access to sensitive information. In certain cases, the IRS requires it. These questions come from an integration with LexisNexis, a global provider of legal, regulatory, and business analytics. You can learn more about them at the LexisNexis Website.

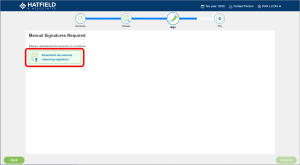

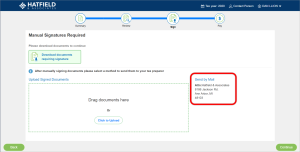

What if I am unable to answer the identity questions or have answered them incorrectly and now it’s forcing me to manual sign?

Please reach out to the contact person listed on the top right-hand corner of your screen. The HeimLantz professional will guide you through the next steps.

I am unable to electronically sign. What should I do?

- Please make sure you are using the recommended web browsers: Google Chrome, Firefox, Safari, or Edge.

- Ensure your caches are cleared and have a stable internet connection

- If using a mobile device, please make sure the link is opening in a web browser app and not inside of the email app.

Does SafeSend Returns offer a mobile app?

No. A SafeSend Returns mobile app is not currently available. Taxpayers can sign a return using any modern web browser on a desktop or mobile device. We recommend using Google Chrome for the best experience.

Can my spouse and I use the same email address to sign a joint return?

Yes. After the first taxpayer signs the return, the second taxpayer will receive an email from SafeSend Returns with an access link to sign the return.

Will I receive email reminders for all tax payments and estimated payments, if applicable?

Yes. You will automatically receive a 7-day reminder as you approach a payment due date. There will be an opportunity to opt-in, or out, and customize your payment reminder settings to best fit your schedule.

How is this different from e-filing?

SafeSend Returns allow you to electronically sign your e-file authorization forms and print and download your return. This will not submit your return to the IRS. Upon completion of e-signing your return, HeimLantz will be notified and will continue to file and submit your return to the IRS.

What about my source documents? What happens to them?

A HeimLantz professional will be in contact with you and arrange a method of returning the source documents to you. This will most likely occur after the submission of the return to the IRS.

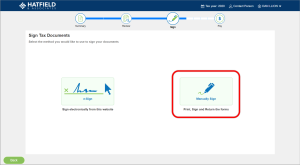

Can I print, sign, and mail my e-file authorizations form(s) rather than e-signing?

- Yes. You can print, sign, and either mail your e-file forms to your accountant or upload them onto SafeSend Returns.

- If you wish to print, sign, and mail your e-file forms to us, please select the “Manually Sign” button on the Sign Tax Documents section. You can either upload your e-file forms onto SafeSend Returns or send them through your Box client portal.

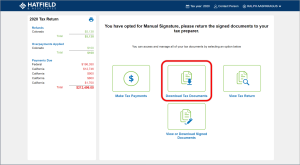

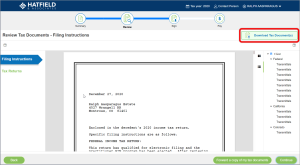

Can I download a copy of my return for my own records?

Yes. While SafeSend Returns automates the delivery and signing of your filing forms, you always have the option to download a copy at any time. You can do this in the following ways:

- While reviewing your return, click Download Tax Document(s), this will prompt your web browser to download a ZIP file containing your return and payment vouchers.

- After completing your return, you can always click Download Tax Document(s)from your Summary page. You can then choose to download all your documents to one ZIP file or to download specific forms.